Investor Day

The document presents a strategy update for ADNOC Distribution's Investor Day, dated February 2024.

ADNOC Distribution: Investor Day Strategy update February 2024 ADNOC Distribution

Agenda Welcome address and agenda 3:30 PM Overview and key messages Focus on HSE and sustainability Strategic update Bader Saeed Al Lamki Athmane Benzerroug Fuel Chief Executive Officer Chief Strategy, Transformation & Non-fuel retail Sustainability Officer Futureproofing and new revenue streams International platforms Financial framework Closing remarks and Q&A 4:45 PM Klaas Mantel Wayne Beifus Chief Operating Officer Chief Financial Officer 2

Disclaimer This communication includes forward-looking statements which relate to, among other things, our plans, objectives, goals, strategies, future operational performance and anticipated developments in markets in which operate and in which we may operate in the future. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond our control and all of which are based on management’s current beliefs and expectations about future events. Forward-looking statements are sometimes identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “could”, “should”, “would”, “intends”, “estimates”, “plans”, “targets”, or “anticipates” or the negative thereof, or other comparable terminology. These forward-looking statements and other statements contained in this communication regarding matters that are not historical facts involve predictions and are based on the beliefs of our management, as well as the assumptions made by, and information currently available to, our management. Although we believe that the expectations reflected in such forward looking statements are reasonable at this time, we cannot assure you that such expectations will prove to be correct. Given these uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to: our reliance on ADNOC to supply us with substantially all of the fuel products that we sell; an interruption in the supply of fuels to us by ADNOC; changes in the prices that we pay ADNOC for our fuels and to the prices that we are allowed to charge our retail customers in the UAE; failure to successfully implement our operating initiatives and growth plans, including our mixed-mode service offering, our convenience store optimization initiatives, our cost savings initiatives, and our growth plans; competition in our markets; decrease in demand for the fuels we sell, including due to general economic conditions, improvements in fuel efficiency and increased consumer preference for alternative fuels; the dangers inherent in the storage and transportation of the products we sell; our reliance on information technology to manage our business; laws and regulations pertaining to environmental protection, operational safety, and product quality; the extent of our related party transactions with ADNOC and our reliance on ADNOC to operate our business; the introduction of VAT and other new taxes in the UAE; failure to successfully implement new policies, practices, systems and controls that we implemented in connection with or following our IPO; any inadequacy of our insurance to cover losses that we may suffer; general economic, financial and political conditions in Abu Dhabi and elsewhere in the UAE; instability and unrest in regions in which we operate; the introduction of new laws and regulations in Abu Dhabi and the UAE; and other risks and uncertainties detailed in our International Offering Memorandum dated 26 November 2017 relating to our initial public offering and the listing of our shares on the Abu Dhabi Securities Exchange, and from time to time in our other investor communications. Except as expressly required by law, we disclaim any intent or obligation to update or revise these forward-looking statements. 3

Overview and Key messages 01 ADNOC Distribution

ADNOC Distribution at a glance 840 40mL 50+ ~600k ~500 service stations in our fuel supplied to customers EV charging points UAE customers convenience stores fuel retail network in the per day (B2C, B2B) across our UAE network served per day in our network in the UAE, KSA and Egypt UAE, KSA and Egypt Retail (B2C) Commercial (B2B) Non-fuel Fuel Convenience Car services Property New energy Corporate Aviation stores management 5

ADNOC Distribution National fuel distribution champion Transformational journey Futureproofing the business Launched next-gen Company included in Opened the Announced ADNOC Distribution Entry into Dubai Capital Markets convenience store and MSCI and FTSE EM 500th station in decarbonization Operation of established and KSA Day: strategic On-the-go compact Indices the UAE roadmap and arranged pilot hydrogen Oct. 1973 markets targets set for station a Sustainability-Linked fueling station 2019-23 Loan 1973 2018 2019 2020 2021 2022 2023 Company’s shares Launched ADNOC Launched Launched EV Developed a Entry into Doubled total listed on ADX Rewards loyalty e-Commerce and charging network of 66 Egypt shareholder Dec. 2017 program mobile fuel service stations in market value since IPO delivery KSA 6

We have delivered on our growth targets May ‘19 CMD: 2023 targets 2023 achievements Low single-digit growth in fuel volumes UAE retail fuel volumes CAGR: 2% Fuel retail Increase UAE network size to c.530-550 stations UAE network: c.530 stations KSA and Egypt network: 311 stations Increase total network size to c.400 C-stores Total network: c.500 C-stores Non-fuel retail Refurbish 100% of 2018 C-store network 90% of UAE C-stores are new or refurbished E-commerce channel Launched e-commerce channel Commercial fuel LPG price optimization LPG price optimization achieved in 2020 New contracts in Dubai New contracts signed in Dubai and the Northern Emirates OPEX 2019-23 like-for-like savings of $100-150 million $130 million like-for-like savings achieved over 2019-23 68 stations in KSA and acquisition of 50% in Total International growth Expansion in KSA and exploring other areas Energies Marketing Egypt Lubes exports to more than 30 markets EBITDA of >$1 billion EBITDA of >$1 billion Financial targets Up to 2x Net debt to EBITDA, ROCE min. 20% 0.6x Net debt to EBITDA, ROCE 26% CAPEX $1.2-1.4bn 2019-23 CAPEX $1.2bn 7

ADNOC Rewards | Growing customer lifetime value through developing one-on-one digital relationships ~2 million members, +22% Y-o-Y 3X 5X retail fuel volumes Y-o-Y growth in 2023 by active fuel and non-fuel transactions Y-o-Y growth in 2023 ADNOC Rewards members vs. total retail fuel by active ADNOC Rewards members vs. total fuel and volumes growth non-fuel transactions growth New system of TIERs offering personalized rewards 8

ADNOC Distribution 2028 ambition Establish ADNOC Distribution +50% ~1,000 as a multi-energy, convenience (1) and mobility leader Increase in number of non-fuel Station network transactions 2023: 840 Hyper-personalized digital-first experience to drive customer engagement, footfall and monetization Deliver EBITDA 10-15x up to $50m growth over 2024-28 Fast and super-fast EV charging points in Like-for-like OPEX savings the UAE vs. 2023, in a disciplined roll-out approach 2023: 50+ 9 1. Includes convenience stores, car wash, lube change transactions.

Extending ADNOC Distribution core strengths and capabilities into new business models wNe Vehicle servicing Futureproofing Fleet solutions Core fuel retail & commercial QSR master franchise Leveraging core strengths to develop world-class capabilities in the local UAE market through the ADNOC ls Food & grocery convenience Distribution core strategy de Digital ventures Adjacencies Sustainability solutions Strengthening capabilities gives ADNOC Distribution license to grow and unlock new value pools, i.e. new Adjacencies business models & new geographies Business mo (e.g., NFR, EV, lubes, Futureproofing franchising) ✓ New sectors outside of ADNOC Distribution core domain can be accelerated via acquisition or partnerships Core fuel retail ✓ Enables ADNOC Distribution to extract more value ng from more channels and create new platforms to stiExi& commercial future-proof the business beyond fuel Existing Geographies New 10

New dividend policy proposal provides payback visibility and upside from future earnings growth Dividend framework Current policy New policy proposal: (1) $3.7bn 2024-28 dividends distributed Payment of Min. $700m since IPO dividends $700m or ADNOC Distribution is twice each fiscal year in 2023, min. 75% committed to deliver (first payment in min. 75% of net profit, whichever attractive and visible October and a second of distributable profit is higher shareholder payback payment in April of the thereafter supported by strong following year) sustainable earnings growth, predictable cashflow profile and strong balance sheet 11 1. Subject to shareholders’ approval at the General Assembly Meeting scheduled for March 2024

Focus on HSE And sustainability

Committed to 100% HSE World-class safety metrics (1) LTIF(2) TRIR Zero 0.03 0.03 0.03 0.03 fatalities in 2023 Zero catastrophic 2022 2023 2022 2023 events in 2023 WELL Health Safety Rating in 2023 awarded for entire network in the UAE (500+ sites) Testament to our commitment to maintain the highest level of healthy environment and safety practices for our staff and customers 1. Total Recordable Injury Rate = Total recordable injury / million manhours 13 2. Lost Time Injury Frequency = Lost time to injury / million manhours

An inclusive sustainability partner Main sustainability projects delivered in 2023 First UAE fuel retailer to announce Install PV solar panels Power 100% of heavy vehicle First high-speedhydrogen 2030 decarbonization roadmap & across our network fleet with biofuel refueling station in the Middle East convert an existing ($1.5bn) loan to sustainability-linked loan First fuel retailer to receive IntroducedReverse First fuel retailer to offer Introduced ADD “e-COOL LL” WELL Health-Safety Rating in the Vending Machine customers the opportunity engine coolant tailored for EVs to MENA region for service stations recycling service to adopt a mangrove & fulfill growing customers’ needs monitor it live 14

Placing sustainability at the core of our operations and futureproofing the business Strategic initiatives 2023 achievements Tomorrow Energy optimization Reduce energy use across our assets through efficient systems and optimized building designs ~10% reduction in Scope 1 and Scope 2 emissions PV solar compared to 2022 Grow network of solar-powered service stations Target Biofuel Introduce biofuel in 100% of ADNOC Distribution supply chain vehicles 25% Becoming the partner of Fleet management reduction in Scope 1 & Scope 2 emissions choice for sustainable Introduce real-time fleet tracking to improve fuel intensity by 2030 compared to 2021 baseline mobility solutions efficiency 15

Strategic update

In line with global trends, our market is transforming with changing consumer needs Accelerated energy Technology advances Lifestyle changes offer new transition leading to a rise creating disruptive & digital opportunities in convenience in alternative fuels opportunities as well as mobility 17

Our strategy focuses on driving sustainable earnings growth and attractive returns for shareholders Vision Pillars Become a multi-energy, Deliver profitable Build international Futureproofing & new convenience and mobility domestic growth platforms revenue streams leader Retail: enhance returns of core assets Retail: expand the assets • Electric vehicles: • Leverage on highly attractive and • KSA: well-positioned to access premium-margin on- Purpose growing core UAE energy market capitalize on evolving market the-go EV charging value pool Provide a world-class customer • Reallocate capital towards • Egypt: maximize earnings • Decarbonization: experience through compelling convenience and mobility to potential achieve 25% reduction in (1) fuel & non-fuel offerings, digital transform our stations as • New accretive markets emissions intensity by 2030 integration & innovation destinations of choice • Alternative fuels: Commercial: continue to grow market Lubricants & LPG: scale-up biofuels & pilot hydrogen share while driving enhanced margins business to create new Mobility solutions: monitor key growth verticals trends Enablers Robust Operating Strong FCF & OPEX & CAPEX Technology & Business Station Network & Model Balance Sheet Optimization Digital Assets Transformation Landbank 18 1. Scope 1 and Scope 2 emissions

Fuel

Fuel retail | Solid outlook driven by population, mobility and car parc growth Macro trends Margins and volumes 2028 Gasoline demand expected to grow at low- Industry-leading UAE single-digit rate retail margin guarantee ~1,000 per supply contract with ADNOC Station network protecting from inventory losses and vs. 840 in 2023 offering upside from inventory gains Strategic initiatives Growing our volumes above market rate Grow our network efficiently by high-grading driven by network expansion and stations and turning them into destinations of management initiatives to increase choice for customers by expanding our non-fuel footfall retail offerings 20 1. Scope 1 and Scope 2 emissions

Fuel retail | Visible industry-leading UAE retail fuel margins and high throughputs Stable and proven Margin downside Retail fuel margin Throughput per station regulatory environment protection Pricing mechanism Margin guarantee $0.13/liter* 12.4mL/pa** UAE pump prices are set Retail margin protection monthly by a committee in agreement with ADNOC which ADNOC Distribution is provides downside protection represented. Pump prices are and a margin floor, and offers benchmarked to market oil upside from inventory gains Global benchmark: Throughput drivers: prices Regulated industry margins Fuel demand Supply contract range from $0.01/liter to growing at a low single-digit % ADNOC Distribution $0.15/liter rate successfully renewed its Unregulated industry margins Low penetration supply agreement with determined by marginal-player UAE: ~4.5K vehicles / station ADNOC for a new 5-year term economics, which can be US, EU and China: ~1.9K effective through Dec. 2027 impacted by volumes, non-fuel vehicles / station retail contribution and cost inflation 21 * 2022: based on the UAE/KSA retail fuel volumes, excluding inventory movements. ** 2023: based on the UAE/KSA retail fuel volumes

Commercial | Scale-up fuel, LPG and lubricants businesses in the attractive markets while exploring inorganic opportunities Main fuels LPG Lubricants Largest markets: Abu Dhabi and the Northern Emirates Largest cylinders markets: Abu Dhabi emirate - Dubai Demand driven by: higher population and number of Gasoil demand driven by: construction industry (65- emirate for bulk LPG cars 70%), heavy transport (15-20%) Demand driven by: Growing investments in industrial sector resulting in - industrial sector increased manufacturing & construction activities - construction of malls and hotels Growing logistics of raw materials and industrial - hospitality sector output drive demand for automotive & marine - single-owned restaurants (demand for cylinders) lubricants UAE diesel demand (mL) 5,010 UAE LPG demand (mL) 1,251 Lubricants Demand (mtpa) CAGR +3.0% 4,888 CAGR +2.5% 1,220 Asia Africa Middle East 4,768 1,190 CAGR +1.3% CAGR +1.3% CAGR +1.8% 4,651 1,173 4,483 1,138 15.8 16.8 4,332 1,102 7.3 7.6 2.3 2.6 1.76 1.9 8.5 9.2 0.6 0.7 0.4 1.7 1.9 0.4 2023 2024 2025 2026 2027 2028 1.4 1.5 2023 2024 2025 2026 2027 2028 2022 2028 2022 2028 2022 2028 Inland transport Inland trasport Non-transport 22 1. Frost and Sullivan (2021 study) Source: S&P Global Commodity Insights, ©2024 by S&P Global Inc.

Commercial | Developing new products and services including decarbonization, fleet mgt. Strategic initiatives Expand bulk fuels, LPG and aviation through value-added fleet/B2B services Grow LPG and lubes domestically and internationally Main fuels LPG Lubricants ▪ Maintain leadership position in the UAE by ▪ Maintain leadership position in the UAE in ▪ Focus on domestic UAE market as a key capturing market demand growth and bulk LPG fuel lubricants segment earnings contributor signing new supply contracts ▪ Digitize LPG cylinder delivery by providing ▪ Capture new export markets and ▪ Direct customer access using a wide last-mile delivery service promoting Voyager brand portfolio of fully-digitized mobile assets ▪ Expand offering of innovative LPG vending ▪ Expand portfolio offering, including ▪ Helping customers to decarbonize their machines and lightweight composite specialties and new fluids (e.g., EV fluids, operations through sustainable fuels cylinders immersion cooling fluids) ▪ Explore inorganic opportunities ▪ Explore inorganic opportunities 23

Non-fuel retail

Non-fuel retail | Evolving into a customer-centric, digitally-enabled ‘foodvenience’ player Macro trends Platform Ambition Globally, retail stations are becoming ‘customer destinations’ for convenience, F&B and adjacent #1 #1 services; the UAE follows similar trends Fuel retailer brand & Multi-energy mobility retailer footprint brand (i.e., by number of coffee outlets) Strategic initiatives #1 #1 Developing our stores into ‘foodvenience’ destinations Convenience brand retailer ‘Foodvenience’ + Energy Leveraging strong car wash, lube change and vehicle (i.e., fresh food + convenience) inspection centers’ footprint to enhance customer experience and become a one-stop car-care destination ~2 million ADNOC Digitally-enabled Leveraging on monetizing premium UAE real estate Rewards members relationship program portfolio driving NFR transactions & margins 25

C-Stores | Format and offer innovation ntme ring formatw anage ffeeoffe ne ory m asisC O categ ery and co ADNO d e h bak Improv resF 26

C-stores | Reinvent as ‘foodvenience’ destinations Strategic initiatives 2028 targets Tomorrow Targeted customer C-stores offering leveraging advanced analytics +25% ‘Foodvenience’ destination number of convenience stores including for longer-stay EV charging customers +50% Bringing Oasis offering to customers e-commerce, Click & Collect non-fuel transactions Disciplined expansion +100% of convenience store footprint Growing customer lifetime value barista-prepared drinks journey management, subscriptions, partnerships 27

Car services | Becoming a one-stop car-care destination Strategic initiatives 2028 targets Tomorrow Expanded offering comprehensive ecosystem for car services: battery, tires, ~3X repair, spare parts, EV services growth in cash washes Tunnel car wash rollout high capacity (10X traditional) with superior customer experience ~2X Digital marketing growth in number of oil changes including subscription model and booking engine ~1.3X Value-added services growth in number of vehicle at vehicle inspection centers leading to higher basket size inspection centers 28

Property management | Monetizing premium real estate portfolio and scaling franchise operations Strategic initiatives 2028 targets Tomorrow Enhance returns (1) of core assets by attracting more QSR brands in our 50+ network, driving additional footfall scale up franchise operations Targeted tenant mix and expand F&B and non-fuel retail offerings ~3X Scale up franchise and sub- yield vs. rental franchise models to capture higher value across the value chain ~2X Launch community hubs (1) focusing on food, grocery and services in dense residential more QSR brands areas 29 1. Quick Service Restaurants

Futureproofing & new revenue streams

Targeting similar profitability from EV charging vs. existing fuel business ICE Energy consumption per 100km Gross margin per 100km Addressable market share 7 liters AED 3.2 100% @AED0.45/liter 2.5x 5x Targeted addressable unit energy unit Gross margin market share to achieve consumption EV vs. ICE profitability of existing EV fuel business 19.5 kWh AED 16.0 ~20% @AED0.80/kWh 31

EV charging | Futureproofing our business with new revenue streams Adoption of EVs UAE target: 50% EV penetration of car parc in 2050, according to Ministry of Energy and Infrastructure Targeting similar profitability per vehicle vs. existing fuel business, provided high-margin, fast On-the-Go captures ~20% of EV customers’ charging needs Offering the best EV charging customer journey We know our customers and aim to shape and guide them – our UAE On-the-Go network is accessible, available, and convenient Pursuing leadership with an aim to own the EV customer through super-fast charging and convenience, focusing on high-traffic sites and creating a nationwide EV hub network Disciplined rollout of EV chargers to be calibrated on a regular basis depending on the actual EV uptake and using best-in-class technology, balancing growth and utilization of 10X On-the-Go CPs in 2028 vs. 2023 Building convenience retail offering to maximize cross-selling 32

Customer-centric | We are placing the customer at the heart of what we do Leading the way Rewarding journeys Seamless fueling Frictionless retail Industry-leading Enhanced loyalty customer experiences Robust program with loyalty TIERs and through continuous enhanced offers innovation & digital enhancements Regional-first rollout of seamless fueling using In car ordering through mobile app, delivery or pre-stored preferences and license plate collection of retail and F&B across key locations recognition Innovative experiences Personalized services Smart operations showcasing regional-first robotic fueling and 3D anamorphic canopy designs Aim to offer subscription model for car wash and Computer vision cameras for smart station 33 other services for enhanced convenience operations using AI and machine learning

International platforms

Increasing contribution from international operations - KSA and Egypt Macro trends: KSA/Egypt Retail Commercial Growth in car parc by strong economy growth, Leveraging on strong Aviation industrialization and late uptake of EVs ADNOC brand Expand to new airlines in Egypt Tourism growth and new airports Promote in KSA and Egypt by re- branding existing stations & opening new sites to drive higher volumes, footfall & better customer Lubricants Strategic initiatives experience Accelerate rollout of Voyager brand KSA: network optimization, modernization NFR offering in KSA and Egypt and rebranding of stations, disciplined growth Add brewed barista coffee and fresh Egypt: build on synergies to expandaviation packaged merchandise in C-stores, segmentand growlubricantmarket share explore VIC opportunities New markets: continue to evaluate opportunities in other international markets 35

KSA | 2023: building our branded platform ~10,000 ~15% 0.15 0.05 total number of stations share of top 3 players SAR/liter gasoline retail SAR/liter diesel retail in a highly fragmented on KSA fuel retail market fuel margin (vs. non-organized fuel margin KSA retail fuel market players SAR0.09/liter) 68 ~85% ~20% 12 ADNOC Distribution of KSA network branded increase in volumes ADNOC Oasis convenience stations in KSA ADNOC vs.56% end of 2022 post rebranding stores 100% by end of 2024 36

KSA | Build on sustainable foundation set in Central & Eastern province togrow share in the large market Strategic initiatives Enablers Environment is changing towards organized players, and brings market Capitalize on consolidation opportunities offered by new government regulations(1) New CAPEX requirements call for incentive measures offering retail fuel margin upside Mobile fuel delivery, LPG, B2B contracts/app launch, vehicle inspection Bring business resilience centers by exploring new revenue lines and Redefine ADNOC Oasis value proposition, growing NFR improve property occupancy, add rental units 37 1. Scoring dimensions: (1) # of fuel stations, (2) Years of experience, (3) Saudization, (4) Geographic coverage of 13 states and provinces, (5) # of fuel stations located outside major 12 cities, (6) Assets and investments deployed.

Egypt | At a glance: structurally-attractive growth market Commercial Retail Lubricants Aviation Fuel retail Deregulated business Deregulated business Regulated fuel margins but increased annually Driven by GDP Driven by tourism activity Driven by population growth and mobility Limited exposure to EGP USD denominated Convenience retail growth 35kT 190mL 243 2.4bL lubricants aviation fuel volume station network retail fuel volume ~30% ~50% 138 ~20% Lubricants segment Aviation fueling segment C-stores Retail segment EBITDA contribution EBITDA contribution EBITDA contribution 38

Egypt | Building on synergies to expandaviation segmentand grow lubricant market share Strategic initiatives Two successful brands coming together Growing tourism in Egypt supports expansion of aviation business to more airlines Grow lubricants business leveraging on a dual-brand portfolio Enhance resilience of retail network: premium convenience and B2B fleet services Uptake in volumes following targeted rebranding of stations to ADNOC 39

Financial framework

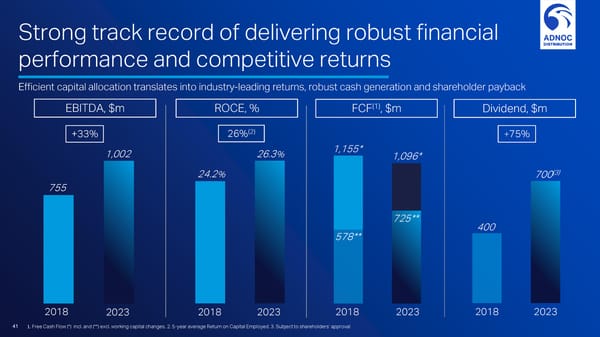

Strong track record of delivering robust financial performance and competitive returns Efficient capital allocation translates into industry-leading returns, robust cash generation and shareholder payback EBITDA, $m ROCE, % (1) FCF , $m Dividend, $m (2) +33% 26% +75% 1,002 26.3% 1,155* 1,096* 24.2% 700(3) 755 725** 400 578** 2018 2023 2018 2023 2018 2023 2018 2023 41 1. Free Cash Flow (*) incl. and (**) excl. working capital changes. 2. 5-year average Return on Capital Employed. 3. Subject to shareholders’ approval

Delivering EBITDA growth in 2024-28: key strategic initiatives and focus areas Incremental EBITDA Initiatives to drive EBITDA growth in the strategic period Retail fuel Commercial Non-fuel New energy Cost Inorganic optimization opportunities Core UAE – Convenience & Mobility International growth Fuel Non fuel retail Cost optimisation Future proofing ▪ Grow retail fuel network to capture ▪ Increase C-store conversion rate ▪ Drive initiatives to deliver further ▪ Fast-charging EV network ▪ KSA and Egypt organic growth demand growth & grow market share ▪ Launch community hubs; upgrade OPEX reduction ▪ Pioneer EV B2B hubs ▪ Develop capital-efficient in Dubai & NE tenant mix ▪ Continuous focus on CAPEX and ▪ Lead energy transition to help operating model to scale up ▪ Scale up mobile fuel delivery via ▪ Revamp car wash & lube bays, OPEX optimization customers decarbonize existing KSA business organic & inorganic options introduce car services ▪ Redesign retail operating model ▪ Focus on dollarized aviation and ▪ New commercial contracts ▪ Grow vehicle inspection network, EV ▪ Leveraging AI & analytics lubricants in Egypt ▪ Launch digitalized commercial servicing & mobile services ▪ Explore other international offering ▪ Build Quick Service Restaurants opportunities 42 platform

Capital discipline and a robust balance sheet Balance sheet CAPEX & returns 0.62x $1.2bn Net debt/EBITDA -2023 CAPEX in 2019-23 $1.6bn ~70% Liquidity in form of cash and unutilized of CAPEX allocated to growth credit facility - 2023 $3.2bn 26% Cash generation in 2019-23 Return on Capital Employed 2019-23 average 43

Optimization programme in place to deliver $50 million in additional savings over 2024-28 Like-for-like OPEX savings, 2019-23, $ million 2024-28 initiatives 10-15% Targeting up to $50 million OPEX savings through: 30-35% • Payment Systems Standardization • Contracting & Procurement 130 Savings • Machine learning and AI 55-60% • Outsourcing • Fleet optimization • Energy efficiency Manpower efficiency Operational efficiency Backoffice optimization Total 44

Construction cost optimization and CAPEX outlook Base 2020-23: cost of building construction 2024-28: CAPEX outlook reduced by more than 20% Engineering optimisation: ✓ More compact service station with higher plot utilization ratio $250-300m ✓ Building Information Modelling (BIM) technology in 2019 & earlier: engineering per annum traditional designs ✓ Different construction technology for civil works and building structures ✓ Lean designs for canopy & building facades 70% ✓ Locally manufactured finishes and systems focused on growth projects Tendering/procurement strategy: ✓ New tendering strategy 45

Closing remarks

ADNOC Distribution unique value proposition Solid business performance Deliver incremental and Deliver higher shareholder and cash flow visibility sustainable growth payback Demonstrable solid business performance Establish ADNOC Distribution as a multi- Proven track-record of shareholder value reinforced by strong 2023 operating and energy, convenience and mobility leader creation since IPO: financial results with over 25% ROCE Predictable cash flow generation Deliver EBITDA growth in 2024-28 through Total shareholder return: $8.2 billion supported by robust regulatory framework, identified key strategic initiatives and focus (+100%) industry-leading margins in the UAE and areas, including doubling down on non-fuel limited exposure to oil price volatility retail and sweating the assets Attractive dividend policysupported by 5-year supply contract with ADNOC, Accelerate sustainable and profitable visible cash flow profile and strong offering a retail margin guarantee which growth domestically and internationally balance sheet protects against inventory losses while through efficient capital allocation providing earnings upside from inventory Futureproof the business by unlocking new gains in fuel retail business (c.65% of revenue streams offered by energy (1) EBITDA) transition (incl. EV charging) and pursuing New 2024-28 dividend policy proposal sustainability goals $700m or min. 75% of net profit Strong balance sheet with ample liquidity whichever is higher, providing payback supports growth prospects and attractive Accelerate digital transformation visibility and dividend upside from future shareholder distributions to create incremental value and enhance earrings growth customer loyalty Unlock hidden value through OPEX initiatives 47 1. Subject to shareholders’ approval at the General Assembly Meeting scheduled for March 2024

Q&A