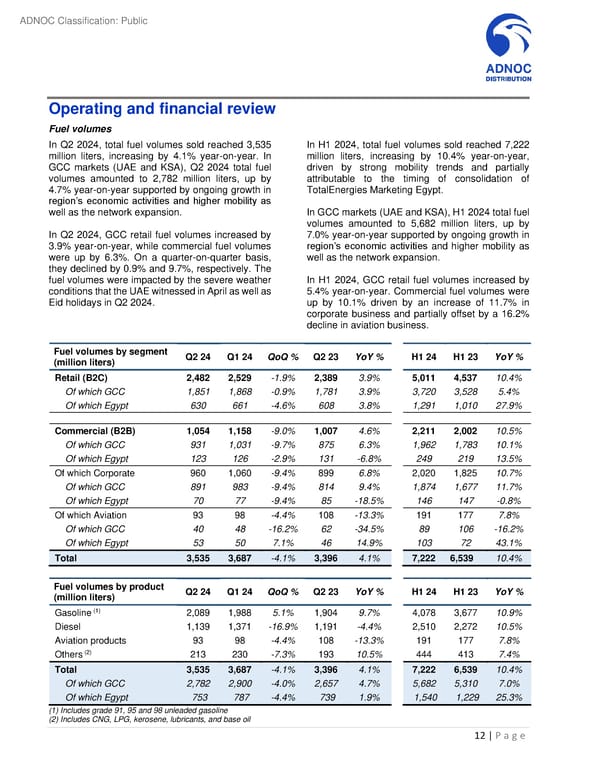

ADNOC Classification: Public Operating and financial review Fuel volumes In Q2 2024, total fuel volumes sold reached 3,535 In H1 2024, total fuel volumes sold reached 7,222 million liters, increasing by 4.1% year-on-year. In million liters, increasing by 10.4% year-on-year, GCC markets (UAE and KSA), Q2 2024 total fuel driven by strong mobility trends and partially volumes amounted to 2,782 million liters, up by attributable to the timing of consolidation of 4.7% year-on-year supported by ongoing growth in TotalEnergies Marketing Egypt. region’s economic activities and higher mobility as well as the network expansion. In GCC markets (UAE and KSA), H1 2024 total fuel volumes amounted to 5,682 million liters, up by In Q2 2024, GCC retail fuel volumes increased by 7.0% year-on-year supported by ongoing growth in 3.9% year-on-year, while commercial fuel volumes region’s economic activities and higher mobility as were up by 6.3%. On a quarter-on-quarter basis, well as the network expansion. they declined by 0.9% and 9.7%, respectively. The fuel volumes were impacted by the severe weather In H1 2024, GCC retail fuel volumes increased by conditions that the UAE witnessed in April as well as 5.4% year-on-year. Commercial fuel volumes were Eid holidays in Q2 2024. up by 10.1% driven by an increase of 11.7% in corporate business and partially offset by a 16.2% decline in aviation business. Fuel volumes by segment Q2 24 Q1 24 QoQ % Q2 23 YoY % H1 24 H1 23 YoY % (million liters) Retail (B2C) 2,482 2,529 -1.9% 2,389 3.9% 5,011 4,537 10.4% Of which GCC 1,851 1,868 -0.9% 1,781 3.9% 3,720 3,528 5.4% Of which Egypt 630 661 -4.6% 608 3.8% 1,291 1,010 27.9% Commercial (B2B) 1,054 1,158 -9.0% 1,007 4.6% 2,211 2,002 10.5% Of which GCC 931 1,031 -9.7% 875 6.3% 1,962 1,783 10.1% Of which Egypt 123 126 -2.9% 131 -6.8% 249 219 13.5% Of which Corporate 960 1,060 -9.4% 899 6.8% 2,020 1,825 10.7% Of which GCC 891 983 -9.4% 814 9.4% 1,874 1,677 11.7% Of which Egypt 70 77 -9.4% 85 -18.5% 146 147 -0.8% Of which Aviation 93 98 -4.4% 108 -13.3% 191 177 7.8% Of which GCC 40 48 -16.2% 62 -34.5% 89 106 -16.2% Of which Egypt 53 50 7.1% 46 14.9% 103 72 43.1% Total 3,535 3,687 -4.1% 3,396 4.1% 7,222 6,539 10.4% Fuel volumes by product Q2 24 Q1 24 QoQ % Q2 23 YoY % H1 24 H1 23 YoY % (million liters) (1) Gasoline 2,089 1,988 5.1% 1,904 9.7% 4,078 3,677 10.9% Diesel 1,139 1,371 -16.9% 1,191 -4.4% 2,510 2,272 10.5% Aviation products 93 98 -4.4% 108 -13.3% 191 177 7.8% Others (2) 213 230 -7.3% 193 10.5% 444 413 7.4% Total 3,535 3,687 -4.1% 3,396 4.1% 7,222 6,539 10.4% Of which GCC 2,782 2,900 -4.0% 2,657 4.7% 5,682 5,310 7.0% Of which Egypt 753 787 -4.4% 739 1.9% 1,540 1,229 25.3% (1) Includes grade 91, 95 and 98 unleaded gasoline (2) Includes CNG, LPG, kerosene, lubricants, and base oil 12 | P a g e

Second Quarter and First Half 2024 Results Page 11 Page 13

Second Quarter and First Half 2024 Results Page 11 Page 13