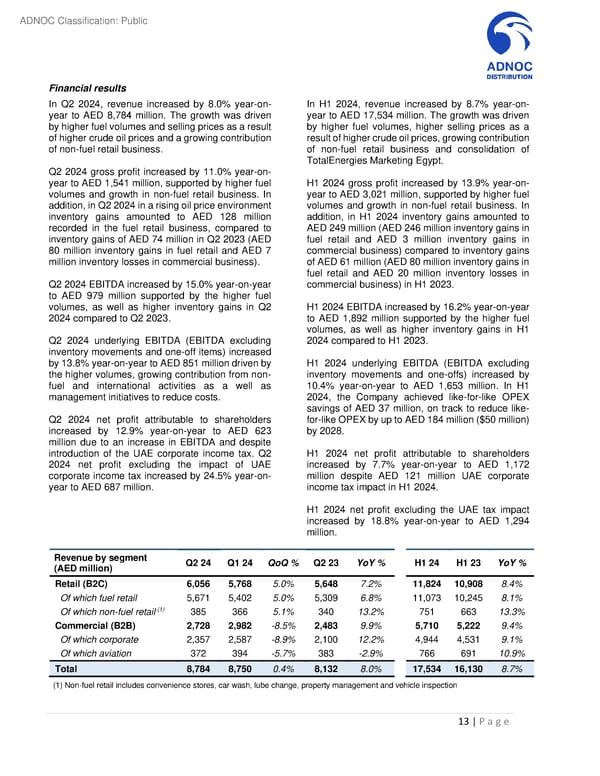

ADNOC Classification: Public Financial results In Q2 2024, revenue increased by 8.0% year-on- In H1 2024, revenue increased by 8.7% year-on- year to AED 8,784 million. The growth was driven year to AED 17,534 million. The growth was driven by higher fuel volumes and selling prices as a result by higher fuel volumes, higher selling prices as a of higher crude oil prices and a growing contribution result of higher crude oil prices, growing contribution of non-fuel retail business. of non-fuel retail business and consolidation of TotalEnergies Marketing Egypt. Q2 2024 gross profit increased by 11.0% year-on- year to AED 1,541 million, supported by higher fuel H1 2024 gross profit increased by 13.9% year-on- volumes and growth in non-fuel retail business. In year to AED 3,021 million, supported by higher fuel addition, in Q2 2024 in a rising oil price environment volumes and growth in non-fuel retail business. In inventory gains amounted to AED 128 million addition, in H1 2024 inventory gains amounted to recorded in the fuel retail business, compared to AED 249 million (AED 246 million inventory gains in inventory gains of AED 74 million in Q2 2023 (AED fuel retail and AED 3 million inventory gains in 80 million inventory gains in fuel retail and AED 7 commercial business) compared to inventory gains million inventory losses in commercial business). of AED 61 million (AED 80 million inventory gains in fuel retail and AED 20 million inventory losses in Q2 2024 EBITDA increased by 15.0% year-on-year commercial business) in H1 2023. to AED 979 million supported by the higher fuel volumes, as well as higher inventory gains in Q2 H1 2024 EBITDA increased by 16.2% year-on-year 2024 compared to Q2 2023. to AED 1,892 million supported by the higher fuel volumes, as well as higher inventory gains in H1 Q2 2024 underlying EBITDA (EBITDA excluding 2024 compared to H1 2023. inventory movements and one-off items) increased by 13.8% year-on-year to AED 851 million driven by H1 2024 underlying EBITDA (EBITDA excluding the higher volumes, growing contribution from non- inventory movements and one-offs) increased by fuel and international activities as a well as 10.4% year-on-year to AED 1,653 million. In H1 management initiatives to reduce costs. 2024, the Company achieved like-for-like OPEX savings of AED 37 million, on track to reduce like- Q2 2024 net profit attributable to shareholders for-like OPEX by up to AED 184 million ($50 million) increased by 12.9% year-on-year to AED 623 by 2028. million due to an increase in EBITDA and despite introduction of the UAE corporate income tax. Q2 H1 2024 net profit attributable to shareholders 2024 net profit excluding the impact of UAE increased by 7.7% year-on-year to AED 1,172 corporate income tax increased by 24.5% year-on- million despite AED 121 million UAE corporate year to AED 687 million. income tax impact in H1 2024. H1 2024 net profit excluding the UAE tax impact increased by 18.8% year-on-year to AED 1,294 million. Revenue by segment Q2 24 Q1 24 QoQ % Q2 23 YoY % H1 24 H1 23 YoY % (AED million) Retail (B2C) 6,056 5,768 5.0% 5,648 7.2% 11,824 10,908 8.4% Of which fuel retail 5,671 5,402 5.0% 5,309 6.8% 11,073 10,245 8.1% (1) Of which non-fuel retail 385 366 5.1% 340 13.2% 751 663 13.3% Commercial (B2B) 2,728 2,982 -8.5% 2,483 9.9% 5,710 5,222 9.4% Of which corporate 2,357 2,587 -8.9% 2,100 12.2% 4,944 4,531 9.1% Of which aviation 372 394 -5.7% 383 -2.9% 766 691 10.9% Total 8,784 8,750 0.4% 8,132 8.0% 17,534 16,130 8.7% (1) Non-fuel retail includes convenience stores, car wash, lube change, property management and vehicle inspection 13 | P a g e

Second Quarter and First Half 2024 Results Page 12 Page 14

Second Quarter and First Half 2024 Results Page 12 Page 14