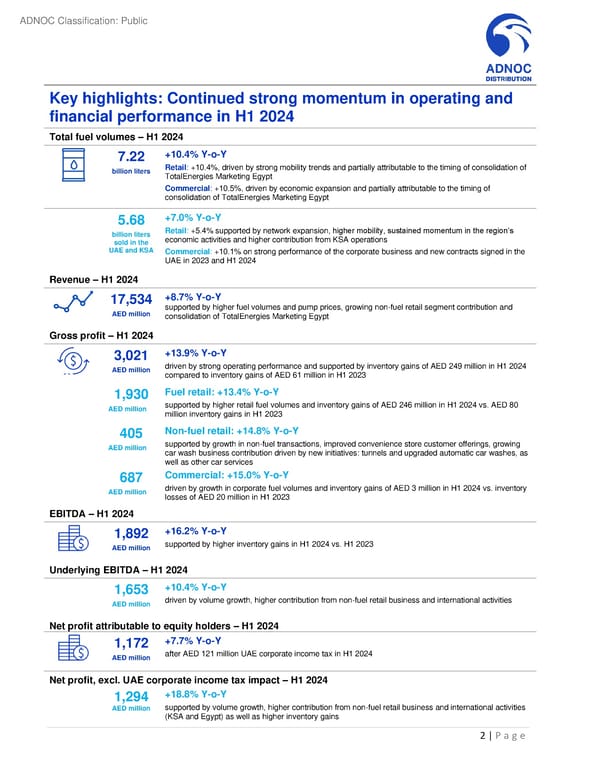

ADNOC Classification: Public Key highlights: Continued strong momentum in operating and financial performance in H1 2024 Total fuel volumes – H1 2024 7.22 +10.4% Y-o-Y billion liters Retail: +10.4%, driven by strong mobility trends and partially attributable to the timing of consolidation of TotalEnergies Marketing Egypt Commercial: +10.5%, driven by economic expansion and partially attributable to the timing of consolidation of TotalEnergies Marketing Egypt 5.68 +7.0% Y-o-Y billion liters Retail: +5.4% supported by network expansion, higher mobility, sustained momentum in the region’s sold in the economic activities and higher contribution from KSA operations UAE and KSA Commercial: +10.1% on strong performance of the corporate business and new contracts signed in the UAE in 2023 and H1 2024 Revenue – H1 2024 17,534 +8.7% Y-o-Y AED million supported by higher fuel volumes and pump prices, growing non-fuel retail segment contribution and consolidation of TotalEnergies Marketing Egypt Gross profit – H1 2024 3,021 +13.9% Y-o-Y AED million driven by strong operating performance and supported by inventory gains of AED 249 million in H1 2024 compared to inventory gains of AED 61 million in H1 2023 1,930 Fuel retail: +13.4% Y-o-Y AED million supported by higher retail fuel volumes and inventory gains of AED 246 million in H1 2024 vs. AED 80 million inventory gains in H1 2023 405 Non-fuel retail: +14.8% Y-o-Y AED million supported by growth in non-fuel transactions, improved convenience store customer offerings, growing car wash business contribution driven by new initiatives: tunnels and upgraded automatic car washes, as well as other car services 687 Commercial: +15.0% Y-o-Y AED million driven by growth in corporate fuel volumes and inventory gains of AED 3 million in H1 2024 vs. inventory losses of AED 20 million in H1 2023 EBITDA – H1 2024 1,892 +16.2% Y-o-Y AED million supported by higher inventory gains in H1 2024 vs. H1 2023 Underlying EBITDA – H1 2024 1,653 +10.4% Y-o-Y AED million driven by volume growth, higher contribution from non-fuel retail business and international activities Net profit attributable to equity holders – H1 2024 1,172 +7.7% Y-o-Y AED million after AED 121 million UAE corporate income tax in H1 2024 Net profit, excl. UAE corporate income tax impact – H1 2024 1,294 +18.8% Y-o-Y AED million supported by volume growth, higher contribution from non-fuel retail business and international activities (KSA and Egypt) as well as higher inventory gains 2 | P a g e

Second Quarter and First Half 2024 Results Page 1 Page 3

Second Quarter and First Half 2024 Results Page 1 Page 3