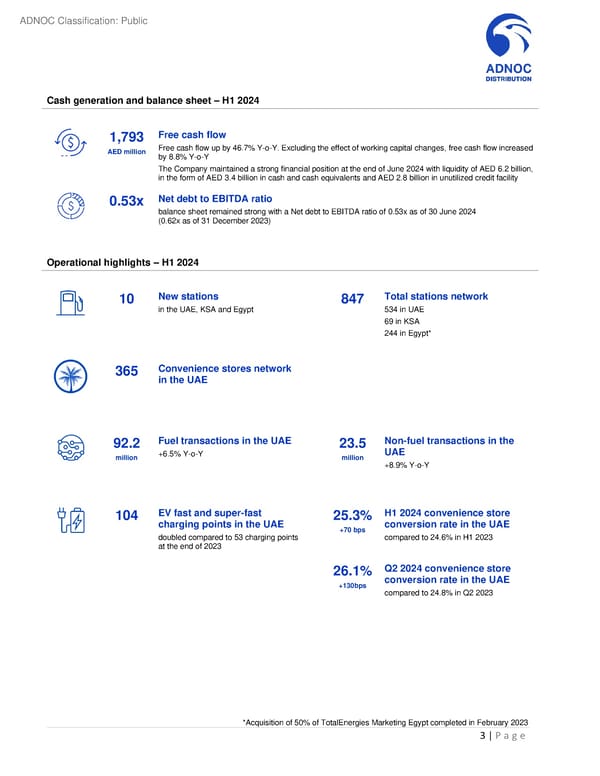

ADNOC Classification: Public Cash generation and balance sheet – H1 2024 1,793 Free cash flow AED million Free cash flow up by 46.7% Y-o-Y. Excluding the effect of working capital changes, free cash flow increased by 8.8% Y-o-Y The Company maintained a strong financial position at the end of June 2024 with liquidity of AED 6.2 billion, in the form of AED 3.4 billion in cash and cash equivalents and AED 2.8 billion in unutilized credit facility 0.53x Net debt to EBITDA ratio balance sheet remained strong with a Net debt to EBITDA ratio of 0.53x as of 30 June 2024 (0.62x as of 31 December 2023) Operational highlights – H1 2024 10 New stations 847 Total stations network in the UAE, KSA and Egypt 534 in UAE 69 in KSA 244 in Egypt* 365 Convenience stores network in the UAE 92.2 Fuel transactions in the UAE 23.5 Non-fuel transactions in the million +6.5% Y-o-Y million UAE +8.9% Y-o-Y 104 EV fast and super-fast 25.3% H1 2024 convenience store charging points in the UAE +70 bps conversion rate in the UAE doubled compared to 53 charging points compared to 24.6% in H1 2023 at the end of 2023 26.1% Q2 2024 convenience store +130bps conversion rate in the UAE compared to 24.8% in Q2 2023 *Acquisition of 50% of TotalEnergies Marketing Egypt completed in February 2023 3 | P a g e

Second Quarter and First Half 2024 Results Page 2 Page 4

Second Quarter and First Half 2024 Results Page 2 Page 4