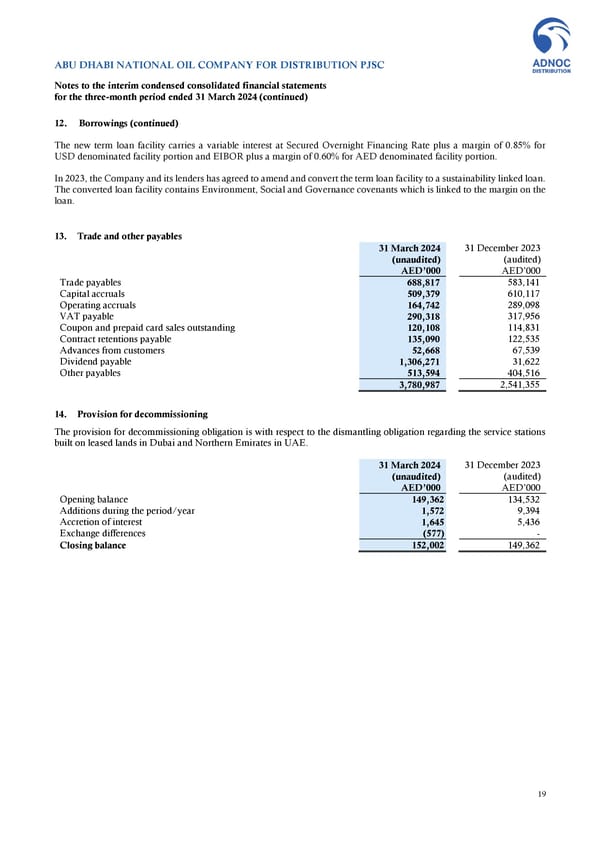

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Notes to the interim condensed consolidated financial statements for the three-month period ended 31 March 2024 (continued) 12. Borrowings (continued) The new term loan facility carries a variable interest at Secured Overnight Financing Rate plus a margin of 0.85% for USD denominated facility portion and EIBOR plus a margin of 0.60% for AED denominated facility portion. In 2023, the Company and its lenders has agreed to amend and convert the term loan facility to a sustainability linked loan. The converted loan facility contains Environment, Social and Governance covenants which is linked to the margin on the loan. 13. Trade and other payables 31 March 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Trade payables 688,817 583,141 Capital accruals 509,379 610,117 Operating accruals 164,742 289,098 VAT payable 290,318 317,956 Coupon and prepaid card sales outstanding 120,108 114,831 Contract retentions payable 135,090 122,535 Advances from customers 52,668 67,539 Dividend payable 1,306,271 31,622 Other payables 513,594 404,516 3,780,987 2,541,355 14. Provision for decommissioning The provision for decommissioning obligation is with respect to the dismantling obligation regarding the service stations built on leased lands in Dubai and Northern Emirates in UAE. 31 March 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Opening balance 149,362 134,532 Additions during the period/year 1,572 9,394 Accretion of interest 1,645 5,436 Exchange differences (577) - Closing balance 152,002 149,362 19

Financial Statements Page 18 Page 20

Financial Statements Page 18 Page 20