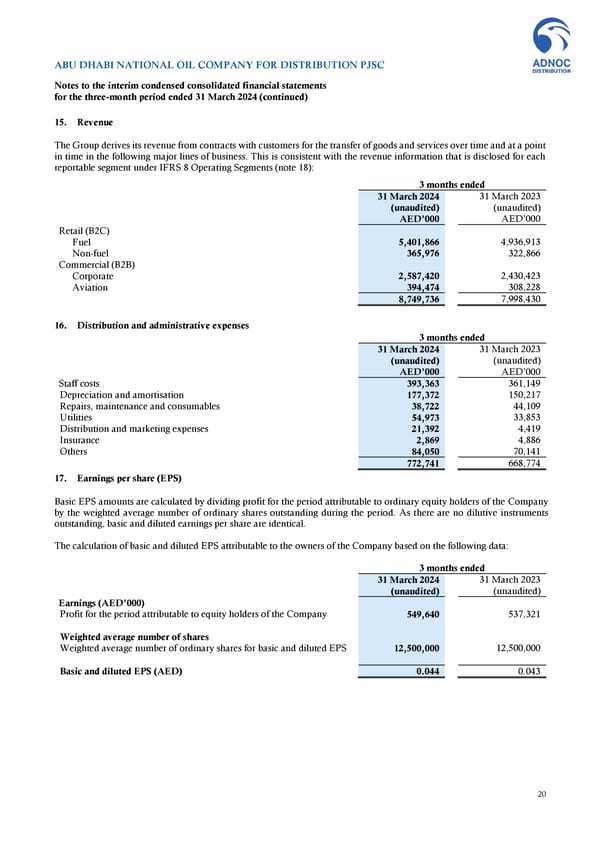

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Notes to the interim condensed consolidated financial statements for the three-month period ended 31 March 2024 (continued) 15. Revenue The Group derives its revenue from contracts with customers for the transfer of goods and services over time and at a point in time in the following major lines of business. This is consistent with the revenue information that is disclosed for each reportable segment under IFRS 8 Operating Segments (note 18): 3 months ended 31 March 2024 31 March 2023 (unaudited) (unaudited) AED’000 AED’000 Retail (B2C) Fuel 5,401,866 4,936,913 Non-fuel 365,976 322,866 Commercial (B2B) Corporate 2,587,420 2,430,423 Aviation 394,474 308,228 8,749,736 7,998,430 16. Distribution and administrative expenses 3 months ended 31 March 2024 31 March 2023 (unaudited) (unaudited) AED’000 AED’000 Staff costs 393,363 361,149 Depreciation and amortisation 177,372 150,217 Repairs, maintenance and consumables 38,722 44,109 Utilities 54,973 33,853 Distribution and marketing expenses 21,392 4,419 Insurance 2,869 4,886 Others 84,050 70,141 772,741 668,774 17. Earnings per share (EPS) Basic EPS amounts are calculated by dividing profit for the period attributable to ordinary equity holders of the Company by the weighted average number of ordinary shares outstanding during the period. As there are no dilutive instruments outstanding, basic and diluted earnings per share are identical. The calculation of basic and diluted EPS attributable to the owners of the Company based on the following data: 3 months ended 31 March 2024 31 March 2023 (unaudited) (unaudited) Earnings (AED’000) Profit for the period attributable to equity holders of the Company 549,640 537,321 Weighted average number of shares Weighted average number of ordinary shares for basic and diluted EPS 12,500,000 12,500,000 Basic and diluted EPS (AED) 0.044 0.043 20

Financial Statements Page 19 Page 21

Financial Statements Page 19 Page 21