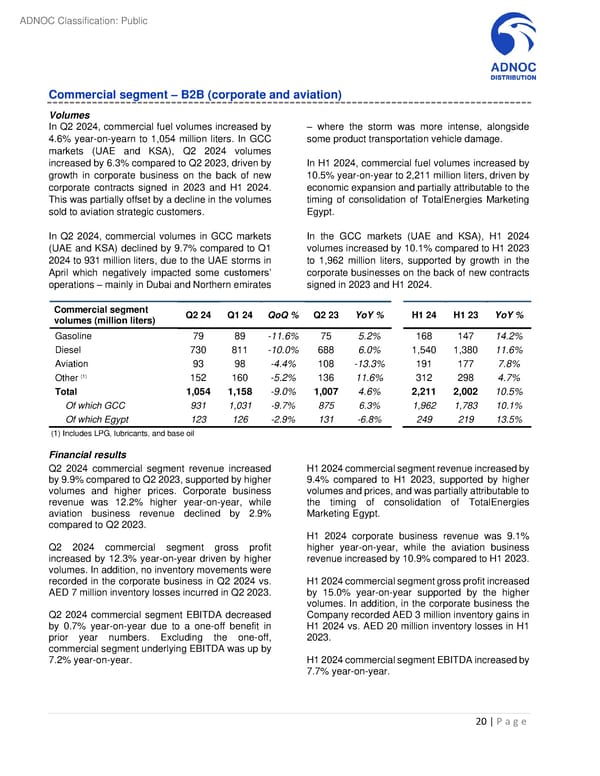

ADNOC Classification: Public Commercial segment – B2B (corporate and aviation) Volumes In Q2 2024, commercial fuel volumes increased by – where the storm was more intense, alongside 4.6% year-on-yearn to 1,054 million liters. In GCC some product transportation vehicle damage. markets (UAE and KSA), Q2 2024 volumes increased by 6.3% compared to Q2 2023, driven by In H1 2024, commercial fuel volumes increased by growth in corporate business on the back of new 10.5% year-on-year to 2,211 million liters, driven by corporate contracts signed in 2023 and H1 2024. economic expansion and partially attributable to the This was partially offset by a decline in the volumes timing of consolidation of TotalEnergies Marketing sold to aviation strategic customers. Egypt. In Q2 2024, commercial volumes in GCC markets In the GCC markets (UAE and KSA), H1 2024 (UAE and KSA) declined by 9.7% compared to Q1 volumes increased by 10.1% compared to H1 2023 2024 to 931 million liters , due to the UAE storms in to 1,962 million liters, supported by growth in the April which negatively impacted some customers’ corporate businesses on the back of new contracts operations – mainly in Dubai and Northern emirates signed in 2023 and H1 2024. Commercial segment Q2 24 Q1 24 QoQ % Q2 23 YoY % H1 24 H1 23 YoY % volumes (million liters) Gasoline 79 89 -11.6% 75 5.2% 168 147 14.2% Diesel 730 811 -10.0% 688 6.0% 1,540 1,380 11.6% Aviation 93 98 -4.4% 108 -13.3% 191 177 7.8% Other (1) 152 160 -5.2% 136 11.6% 312 298 4.7% Total 1,054 1,158 -9.0% 1,007 4.6% 2,211 2,002 10.5% Of which GCC 931 1,031 -9.7% 875 6.3% 1,962 1,783 10.1% Of which Egypt 123 126 -2.9% 131 -6.8% 249 219 13.5% (1) Includes LPG, lubricants, and base oil Financial results Q2 2024 commercial segment revenue increased H1 2024 commercial segment revenue increased by by 9.9% compared to Q2 2023, supported by higher 9.4% compared to H1 2023, supported by higher volumes and higher prices. Corporate business volumes and prices, and was partially attributable to revenue was 12.2% higher year-on-year, while the timing of consolidation of TotalEnergies aviation business revenue declined by 2.9% Marketing Egypt. compared to Q2 2023. H1 2024 corporate business revenue was 9.1% Q2 2024 commercial segment gross profit higher year-on-year, while the aviation business increased by 12.3% year-on-year driven by higher revenue increased by 10.9% compared to H1 2023. volumes. In addition, no inventory movements were recorded in the corporate business in Q2 2024 vs. H1 2024 commercial segment gross profit increased AED 7 million inventory losses incurred in Q2 2023. by 15.0% year-on-year supported by the higher volumes. In addition, in the corporate business the Q2 2024 commercial segment EBITDA decreased Company recorded AED 3 million inventory gains in by 0.7% year-on-year due to a one-off benefit in H1 2024 vs. AED 20 million inventory losses in H1 prior year numbers. Excluding the one-off, 2023. commercial segment underlying EBITDA was up by 7.2% year-on-year. H1 2024 commercial segment EBITDA increased by 7.7% year-on-year. 20 | P a g e

Second Quarter and First Half 2024 Results Page 19 Page 21

Second Quarter and First Half 2024 Results Page 19 Page 21