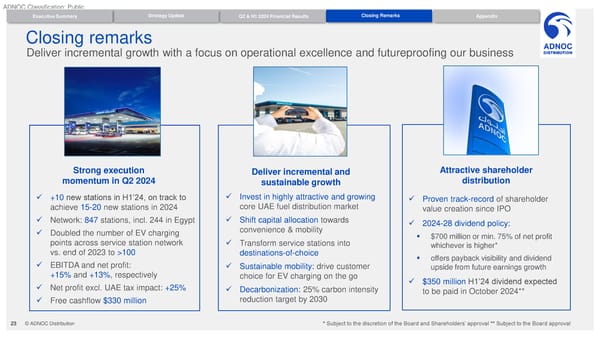

ADNOC Classification: Public Executive Summary Strategy Update Q2 & H1 2024 Financial Results Closing Remarks Appendix Closing remarks Deliver incremental growth with a focus on operational excellence and futureproofing our business Strong execution Deliver incremental and Attractive shareholder momentum in Q2 2024 sustainable growth distribution ✓ +10 new stations in H1’24, on track to ✓ Invest in highly attractive and growing ✓ Proven track-record of shareholder achieve 15-20 new stations in 2024 core UAE fuel distribution market value creation since IPO ✓ Network: 847 stations, incl. 244 in Egypt ✓ Shift capital allocation towards ✓ 2024-28 dividend policy: ✓ Doubled the number of EV charging convenience & mobility ▪ $700 million or min. 75% of net profit points across service station network ✓ Transform service stations into whichever is higher* vs. end of 2023 to >100 destinations-of-choice ▪ offers payback visibility and dividend ✓ EBITDA and net profit: ✓ Sustainable mobility: drive customer upside from future earnings growth +15% and +13%, respectively choice for EV charging on the go ✓ $350 million H1’24 dividend expected ✓ Net profit excl. UAE tax impact: +25% ✓ Decarbonization: 25% carbon intensity to be paid in October 2024** ✓ Free cashflow $330 million reduction target by 2030 23 © ADNOC Distribution * Subject to the discretion of the Board and Shareholders’ approval ** Subject to the Board approval

Q2 / H1 2024 Results Page 22 Page 24

Q2 / H1 2024 Results Page 22 Page 24