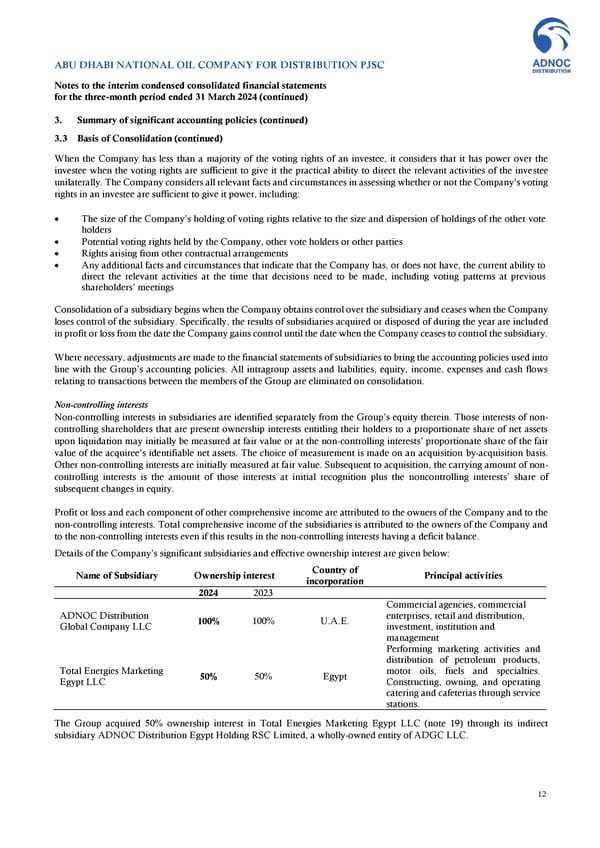

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Notes to the interim condensed consolidated financial statements for the three-month period ended 31 March 2024 (continued) 3. Summary of significant accounting policies (continued) 3.3 Basis of Consolidation (continued) When the Company has less than a majority of the voting rights of an investee, it considers that it has power over the investee when the voting rights are sufficient to give it the practical ability to direct the relevant activities of the investee unilaterally. The Company considers all relevant facts and circumstances in assessing whether or not the Company’s voting rights in an investee are sufficient to give it power, including: • The size of the Company’s holding of voting rights relative to the size and dispersion of holdings of the other vote holders • Potential voting rights held by the Company, other vote holders or other parties • Rights arising from other contractual arrangements • Any additional facts and circumstances that indicate that the Company has, or does not have, the current ability to direct the relevant activities at the time that decisions need to be made, including voting patterns at previous shareholders’ meetings Consolidation of a subsidiary begins when the Company obtains control over the subsidiary and ceases when the Company loses control of the subsidiary. Specifically, the results of subsidiaries acquired or disposed of during the year are included in profit or loss from the date the Company gains control until the date when the Company ceases to control the subsidiary. Where necessary, adjustments are made to the financial statements of subsidiaries to bring the accounting policies used into line with the Group’s accounting policies. All intragroup assets and liabilities, equity, income, expenses and cash flows relating to transactions between the members of the Group are eliminated on consolidation. Non-controlling interests Non-controlling interests in subsidiaries are identified separately from the Group’s equity therein. Those interests of non- controlling shareholders that are present ownership interests entitling their holders to a proportionate share of net assets upon liquidation may initially be measured at fair value or at the non-controlling interests’ proportionate share of the fair value of the acquiree’s identifiable net assets. The choice of measurement is made on an acquisition by-acquisition basis. Other non-controlling interests are initially measured at fair value. Subsequent to acquisition, the carrying amount of non- controlling interests is the amount of those interests at initial recognition plus the noncontrolling interests’ share of subsequent changes in equity. Profit or loss and each component of other comprehensive income are attributed to the owners of the Company and to the non-controlling interests. Total comprehensive income of the subsidiaries is attributed to the owners of the Company and to the non-controlling interests even if this results in the non-controlling interests having a deficit balance. Details of the Company’s significant subsidiaries and effective ownership interest are given below: Name of Subsidiary Ownership interest Country of Principal activities incorporation 2024 2023 Commercial agencies, commercial ADNOC Distribution 100% 100% U.A.E. enterprises, retail and distribution, Global Company LLC investment, institution and management Performing marketing activities and distribution of petroleum products, Total Energies Marketing 50% 50% Egypt motor oils, fuels and specialties. Egypt LLC Constructing, owning, and operating catering and cafeterias through service stations. The Group acquired 50% ownership interest in Total Energies Marketing Egypt LLC (note 19) through its indirect subsidiary ADNOC Distribution Egypt Holding RSC Limited, a wholly-owned entity of ADGC LLC. 12

Financial Statements Page 11 Page 13

Financial Statements Page 11 Page 13