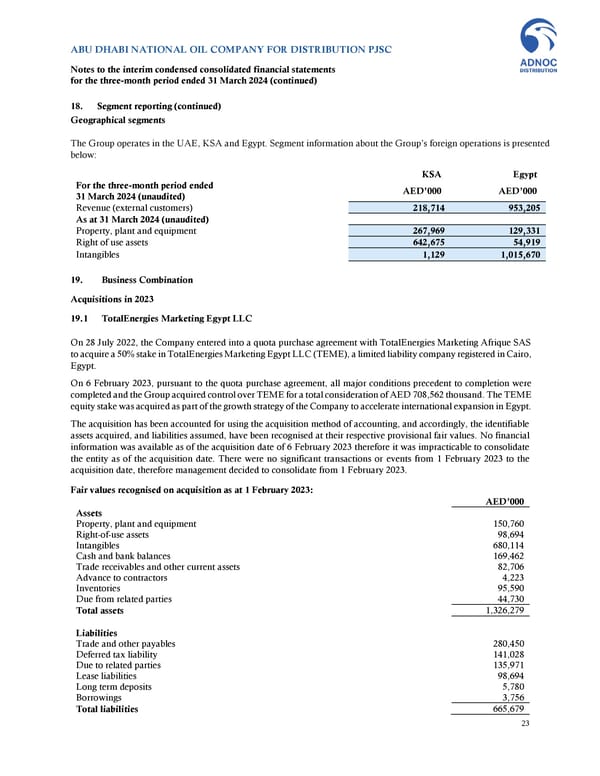

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Notes to the interim condensed consolidated financial statements for the three-month period ended 31 March 2024 (continued) 18. Segment reporting (continued) Geographical segments The Group operates in the UAE, KSA and Egypt. Segment information about the Group’s foreign operations is presented below: KSA Egypt For the three-month period ended AED’000 AED’000 31 March 2024 (unaudited) Revenue (external customers) 218,714 953,205 As at 31 March 2024 (unaudited) Property, plant and equipment 267,969 129,331 Right of use assets 642,675 54,919 Intangibles 1,129 1,015,670 19. Business Combination Acquisitions in 2023 19.1 TotalEnergies Marketing Egypt LLC On 28 July 2022, the Company entered into a quota purchase agreement with TotalEnergies Marketing Afrique SAS to acquire a 50% stake in TotalEnergies Marketing Egypt LLC (TEME), a limited liability company registered in Cairo, Egypt. On 6 February 2023, pursuant to the quota purchase agreement, all major conditions precedent to completion were completed and the Group acquired control over TEME for a total consideration of AED 708,562 thousand. The TEME equity stake was acquired as part of the growth strategy of the Company to accelerate international expansion in Egypt. The acquisition has been accounted for using the acquisition method of accounting, and accordingly, the identifiable assets acquired, and liabilities assumed, have been recognised at their respective provisional fair values. No financial information was available as of the acquisition date of 6 February 2023 therefore it was impracticable to consolidate the entity as of the acquisition date. There were no significant transactions or events from 1 February 2023 to the acquisition date, therefore management decided to consolidate from 1 February 2023. Fair values recognised on acquisition as at 1 February 2023: AED’000 Assets Property, plant and equipment 150,760 Right-of-use assets 98,694 Intangibles 680,114 Cash and bank balances 169,462 Trade receivables and other current assets 82,706 Advance to contractors 4,223 Inventories 95,590 Due from related parties 44,730 Total assets 1,326,279 Liabilities Trade and other payables 280,450 Deferred tax liability 141,028 Due to related parties 135,971 Lease liabilities 98,694 Long term deposits 5,780 Borrowings 3,756 Total liabilities 665,679 23

Financial Statements Page 22 Page 24

Financial Statements Page 22 Page 24