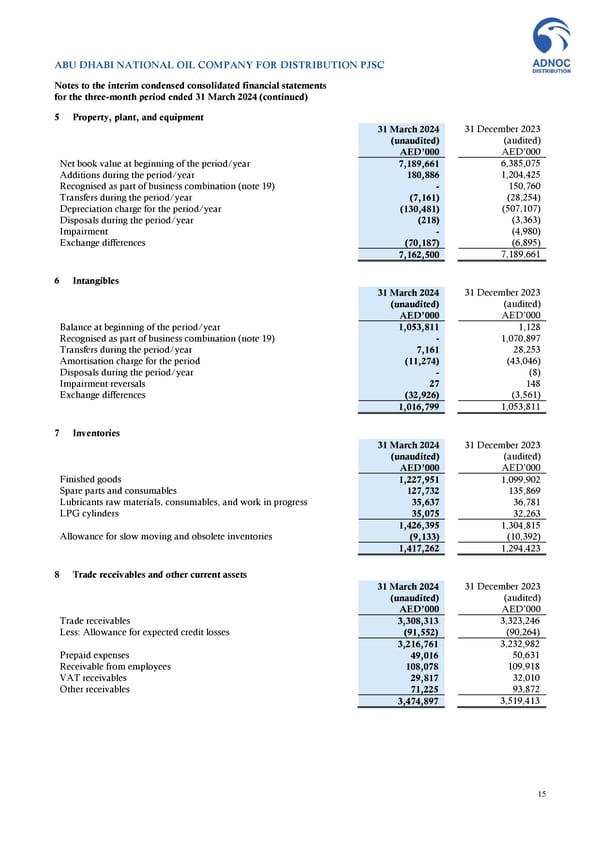

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Notes to the interim condensed consolidated financial statements for the three-month period ended 31 March 2024 (continued) 5 Property, plant, and equipment 31 March 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Net book value at beginning of the period/year 7,189,661 6,385,075 Additions during the period/year 180,886 1,204,425 Recognised as part of business combination (note 19) - 150,760 Transfers during the period/year (7,161) (28,254) Depreciation charge for the period/year (130,481) (507,107) Disposals during the period/year (218) (3,363) Impairment - (4,980) Exchange differences (70,187) (6,895) 7,162,500 7,189,661 6 Intangibles 31 March 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Balance at beginning of the period/year 1,053,811 1,128 Recognised as part of business combination (note 19) - 1,070,897 Transfers during the period/year 7,161 28,253 Amortisation charge for the period (11,274) (43,046) Disposals during the period/year - (8) Impairment reversals 27 148 Exchange differences (32,926) (3,561) 1,016,799 1,053,811 7 Inventories 31 March 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Finished goods 1,227,951 1,099,902 Spare parts and consumables 127,732 135,869 Lubricants raw materials, consumables, and work in progress 35,637 36,781 LPG cylinders 35,075 32,263 1,426,395 1,304,815 Allowance for slow moving and obsolete inventories (9,133) (10,392) 1,417,262 1,294,423 8 Trade receivables and other current assets 31 March 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Trade receivables 3,308,313 3,323,246 Less: Allowance for expected credit losses (91,552) (90,264) 3,216,761 3,232,982 Prepaid expenses 49,016 50,631 Receivable from employees 108,078 109,918 VAT receivables 29,817 32,010 Other receivables 71,225 93,872 3,474,897 3,519,413 15

Financial Statements Page 14 Page 16

Financial Statements Page 14 Page 16