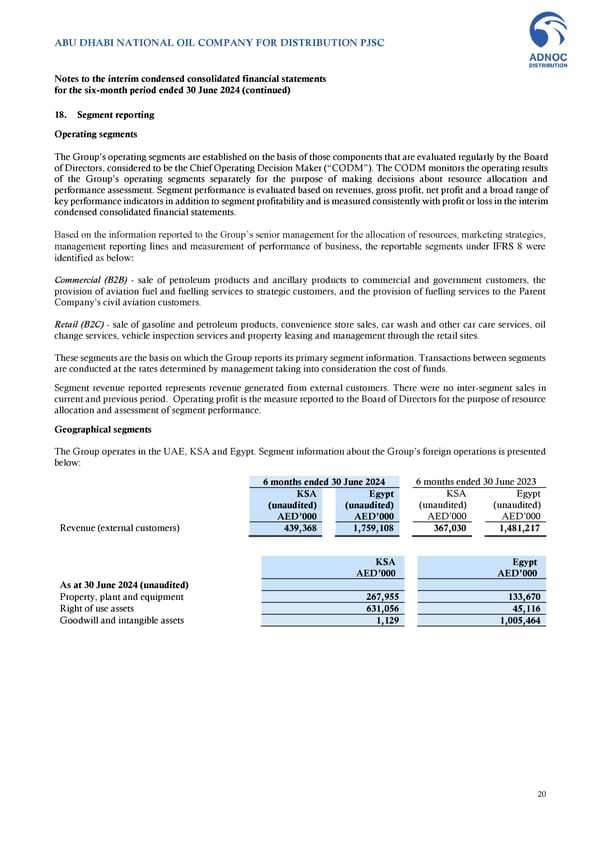

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Notes to the interim condensed consolidated financial statements for the six-month period ended 30 June 2024 (continued) 18. Segment reporting Operating segments The Group’s operating segments are established on the basis of those components that are evaluated regularly by the Board of Directors, considered to be the Chief Operating Decision Maker (“CODM”). The CODM monitors the operating results of the Group’s operating segments separately for the purpose of making decisions about resource allocation and performance assessment. Segment performance is evaluated based on revenues, gross profit, net profit and a broad range of key performance indicators in addition to segment profitability and is measured consistently with profit or loss in the interim condensed consolidated financial statements. Based on the information reported to the Group’s senior management for the allocation of resources, marketing strategies, management reporting lines and measurement of performance of business, the reportable segments under IFRS 8 were identified as below: Commercial (B2B) - sale of petroleum products and ancillary products to commercial and government customers, the provision of aviation fuel and fuelling services to strategic customers, and the provision of fuelling services to the Parent Company’s civil aviation customers. Retail (B2C) - sale of gasoline and petroleum products, convenience store sales, car wash and other car care services, oil change services, vehicle inspection services and property leasing and management through the retail sites. These segments are the basis on which the Group reports its primary segment information. Transactions between segments are conducted at the rates determined by management taking into consideration the cost of funds. Segment revenue reported represents revenue generated from external customers. There were no inter-segment sales in current and previous period. Operating profit is the measure reported to the Board of Directors for the purpose of resource allocation and assessment of segment performance. Geographical segments The Group operates in the UAE, KSA and Egypt. Segment information about the Group’s foreign operations is presented below: 6 months ended 30 June 2024 6 months ended 30 June 2023 KSA Egypt KSA Egypt (unaudited) (unaudited) (unaudited) (unaudited) AED’000 AED’000 AED’000 AED’000 Revenue (external customers) 439,368 1,759,108 367,030 1,481,217 KSA Egypt AED’000 AED’000 As at 30 June 2024 (unaudited) Property, plant and equipment 267,955 133,670 Right of use assets 631,056 45,116 Goodwill and intangible assets 1,129 1,005,464 20

Financial Statements Page 19 Page 21

Financial Statements Page 19 Page 21