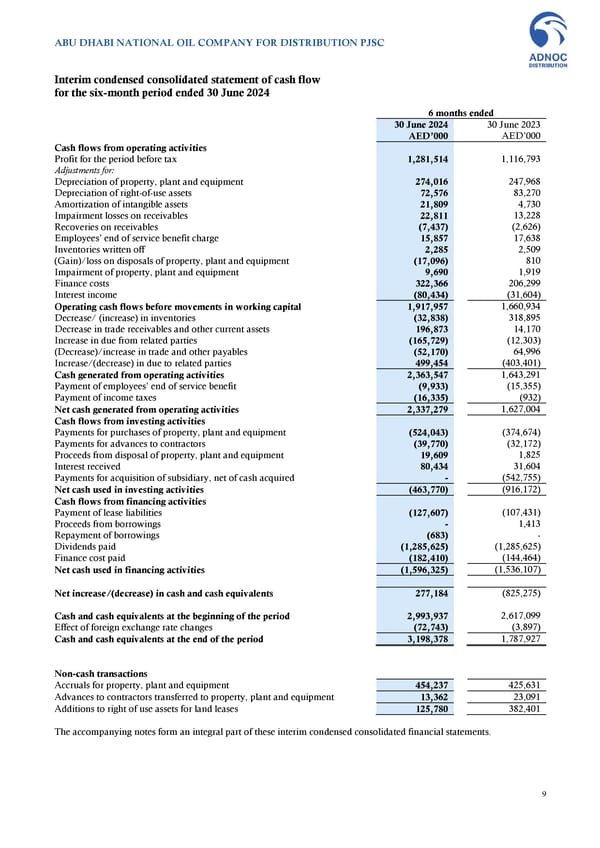

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Interim condensed consolidated statement of cash flow for the six-month period ended 30 June 2024 6 months ended 30 June 2024 30 June 2023 AED’000 AED’000 Cash flows from operating activities Profit for the period before tax 1,281,514 1,116,793 Adjustments for: Depreciation of property, plant and equipment 274,016 247,968 Depreciation of right-of-use assets 72,576 83,270 Amortization of intangible assets 21,809 4,730 Impairment losses on receivables 22,811 13,228 Recoveries on receivables (7,437) (2,626) Employees’ end of service benefit charge 15,857 17,638 Inventories written off 2,285 2,509 (Gain)/loss on disposals of property, plant and equipment (17,096) 810 Impairment of property, plant and equipment 9,690 1,919 Finance costs 322,366 206,299 Interest income (80,434) (31,604) Operating cash flows before movements in working capital 1,917,957 1,660,934 Decrease/ (increase) in inventories (32,838) 318,895 Decrease in trade receivables and other current assets 196,873 14,170 Increase in due from related parties (165,729) (12,303) (Decrease)/increase in trade and other payables (52,170) 64,996 Increase/(decrease) in due to related parties 499,454 (403,401) Cash generated from operating activities 2,363,547 1,643,291 Payment of employees’ end of service benefit (9,933) (15,355) Payment of income taxes (16,335) (932) Net cash generated from operating activities 2,337,279 1,627,004 Cash flows from investing activities Payments for purchases of property, plant and equipment (524,043) (374,674) Payments for advances to contractors (39,770) (32,172) Proceeds from disposal of property, plant and equipment 19,609 1,825 Interest received 80,434 31,604 Payments for acquisition of subsidiary, net of cash acquired - (542,755) Net cash used in investing activities (463,770) (916,172) Cash flows from financing activities Payment of lease liabilities (127,607) (107,431) Proceeds from borrowings - 1,413 Repayment of borrowings (683) - Dividends paid (1,285,625) (1,285,625) Finance cost paid (182,410) (144,464) Net cash used in financing activities (1,596,325) (1,536,107) Net increase/(decrease) in cash and cash equivalents 277,184 (825,275) Cash and cash equivalents at the beginning of the period 2,993,937 2,617,099 Effect of foreign exchange rate changes (72,743) (3,897) Cash and cash equivalents at the end of the period 3,198,378 1,787,927 Non-cash transactions Accruals for property, plant and equipment 454,237 425,631 Advances to contractors transferred to property, plant and equipment 13,362 23,091 Additions to right of use assets for land leases 125,780 382,401 The accompanying notes form an integral part of these interim condensed consolidated financial statements. 9

Financial Statements Page 8 Page 10

Financial Statements Page 8 Page 10