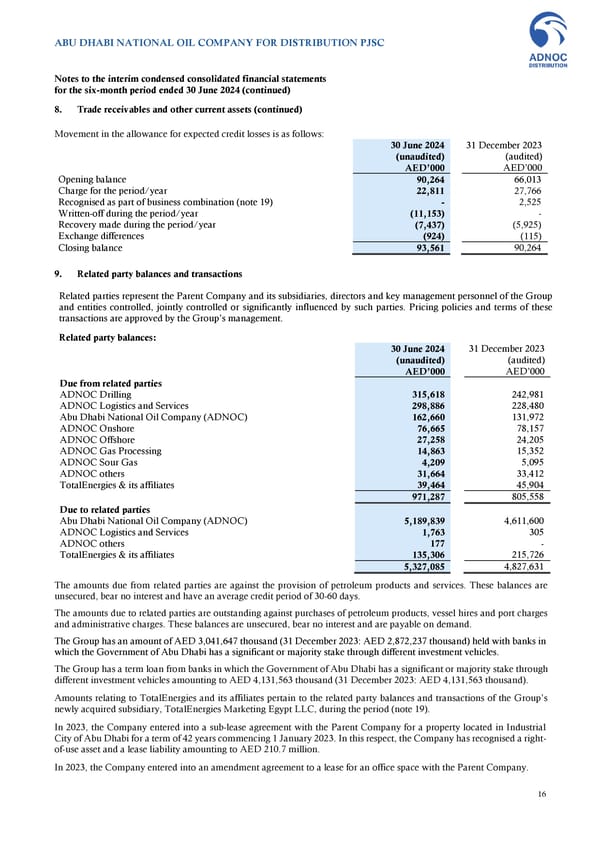

ABU DHABI NATIONAL OIL COMPANY FOR DISTRIBUTION PJSC Notes to the interim condensed consolidated financial statements for the six-month period ended 30 June 2024 (continued) 8. Trade receivables and other current assets (continued) Movement in the allowance for expected credit losses is as follows: 30 June 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Opening balance 90,264 66,013 Charge for the period/year 22,811 27,766 Recognised as part of business combination (note 19) - 2,525 Written-off during the period/year (11,153) - Recovery made during the period/year (7,437) (5,925) Exchange differences (924) (115) Closing balance 93,561 90,264 9. Related party balances and transactions Related parties represent the Parent Company and its subsidiaries, directors and key management personnel of the Group and entities controlled, jointly controlled or significantly influenced by such parties. Pricing policies and terms of these transactions are approved by the Group’s management. Related party balances: 30 June 2024 31 December 2023 (unaudited) (audited) AED’000 AED’000 Due from related parties ADNOC Drilling 315,618 242,981 ADNOC Logistics and Services 298,886 228,480 Abu Dhabi National Oil Company (ADNOC) 162,660 131,972 ADNOC Onshore 76,665 78,157 ADNOC Offshore 27,258 24,205 ADNOC Gas Processing 14,863 15,352 ADNOC Sour Gas 4,209 5,095 ADNOC others 31,664 33,412 TotalEnergies & its affiliates 39,464 45,904 971,287 805,558 Due to related parties Abu Dhabi National Oil Company (ADNOC) 5,189,839 4,611,600 ADNOC Logistics and Services 1,763 305 ADNOC others 177 - TotalEnergies & its affiliates 135,306 215,726 5,327,085 4,827,631 The amounts due from related parties are against the provision of petroleum products and services. These balances are unsecured, bear no interest and have an average credit period of 30-60 days. The amounts due to related parties are outstanding against purchases of petroleum products, vessel hires and port charges and administrative charges. These balances are unsecured, bear no interest and are payable on demand. The Group has an amount of AED 3,041,647 thousand (31 December 2023: AED 2,872,237 thousand) held with banks in which the Government of Abu Dhabi has a significant or majority stake through different investment vehicles. The Group has a term loan from banks in which the Government of Abu Dhabi has a significant or majority stake through different investment vehicles amounting to AED 4,131,563 thousand (31 December 2023: AED 4,131,563 thousand). Amounts relating to TotalEnergies and its affiliates pertain to the related party balances and transactions of the Group’s newly acquired subsidiary, TotalEnergies Marketing Egypt LLC, during the period (note 19). In 2023, the Company entered into a sub-lease agreement with the Parent Company for a property located in Industrial City of Abu Dhabi for a term of 42 years commencing 1 January 2023. In this respect, the Company has recognised a right- of-use asset and a lease liability amounting to AED 210.7 million. In 2023, the Company entered into an amendment agreement to a lease for an office space with the Parent Company. 16

Financial Statements Page 15 Page 17

Financial Statements Page 15 Page 17